- Raising InvestorIQ Newsletter

- Posts

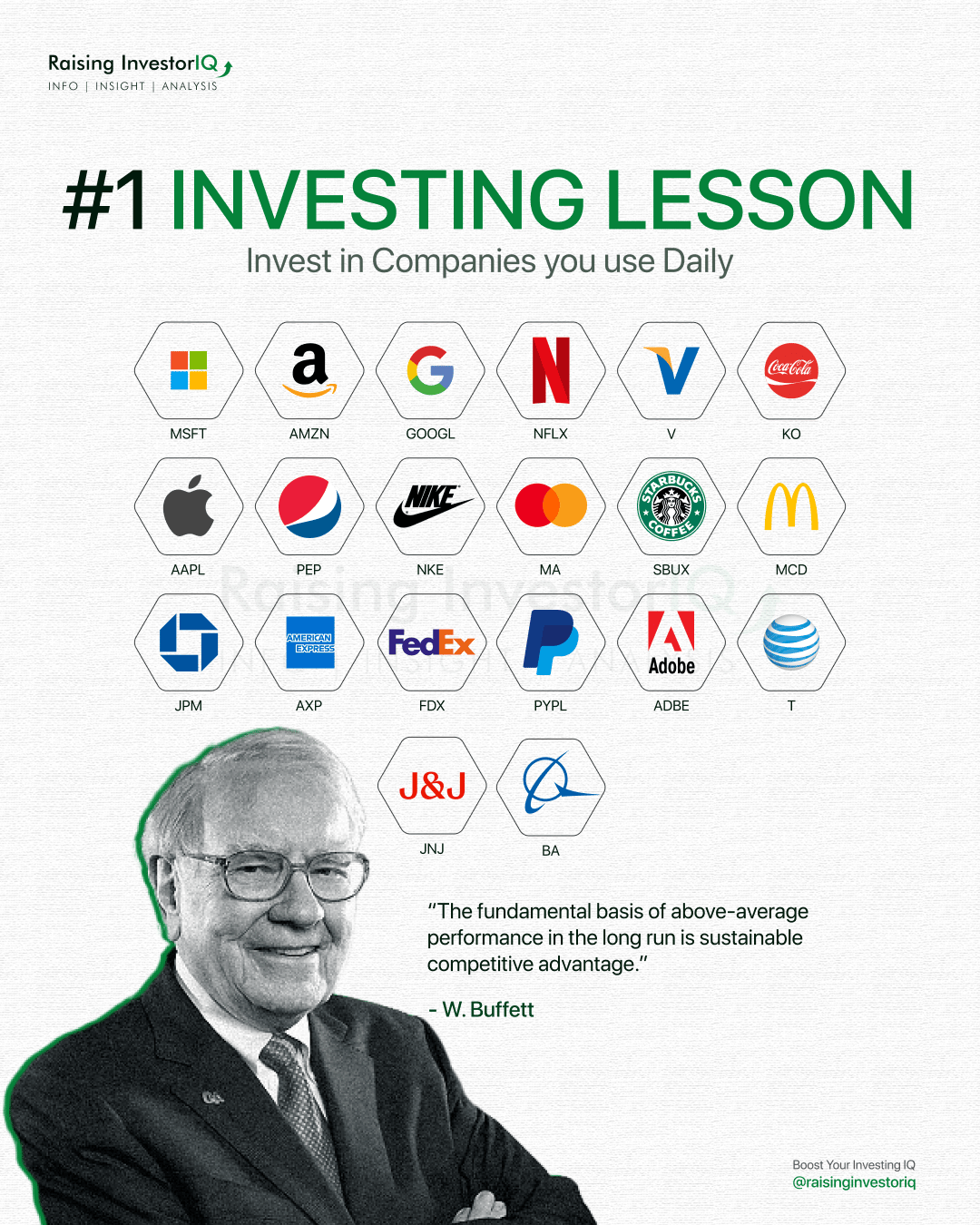

- Invest in What You Know

Invest in What You Know

Never Invest in a Business that You Do Not Understand

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU. PLEASE READ MY DISCLOSURE FOR MORE INFO.

Good morning investors!

If this is your first time reading, welcome to Raising InvestorIQ!

Every weekend we publish a free write-up within our RIIQ Standard Newsletter with leading insight and analysis at a basic level — the aim is to help investors of all skill levels focus on key fundamentals, gain confidence in developing an investment strategy, and gain an edge in the push to generate true wealth.

For more robust, in-depth investment analysis and insights, you should also consider subscribing to our RIIQ Pro Newsletter (30-Day FREE trial).

Sign-Up now and receive this BONUS for FREE: Legendary Insights - 10 legendary insights from 10 legendary investors with practical wisdom to be applied in your investment analysis..

Grab your coffee and let’s dive in!

What You’ll Learn Today

The benefits of considering companies which produce products and provide services you utilize daily as investment opportunities.

How to isolate the very best companies to invest in.

Ways to remove bias when considering investment decisions.

Warren Buffett’s take on investing in what you know.

And don’t miss out on Monday’s premium RIIQ Pro write-up on:

Big Tech’s Investment in AI: Spending Big, Aiming High. Sign up now to read the full write-up! And level up with more cutting edge investment analysis and insights with RIIQ Pro.

Invest in What You Know

Never Invest in a Business That You Do Not Understand

Intro

Take a moment to reflect upon your daily routine. Do you stop at Starbucks on your way to work? How about swinging by Target to grab a few items for dinner on your way home? Now, you’re settling in for the night, so you start a quick show on Netflix.

Investing in companies you interact with daily makes a lot of sense, as consumers are the primary drivers of a company’s success. After all, how would they support their operations if no one bought their products or services? The fundamental need to purchase goods and services opens the door to a new investment strategy: invest where your money goes.

This is also consistent with the premise of investing in businesses you understand. Nine times out of ten, if you’re a direct consumer of a product or service, you’re more likely to understand the business of the company that created it for you. When you're a regular customer, you're more attuned to changes in the business—whether it's a new product launch, improved service, or even a dip in quality. This ground level perspective can surely be leveraged from an investment perspective.

And as legendary investor Warren Buffett so shrewdly advises:

“Never invest in a business that you do not understand.” – Warren Buffett

In this brief write-up, we’ll explore how to invest in companies you use daily, including the benefits and when it might be time to part ways.

The Benefits

Before we get into how to remove bias and make informed investment decisions, let’s cover a few of the benefits of investing in companies you use daily.

Easily Spot Trends

When you are engaged with products and services on a daily basis, you spot trends and potential shortcomings in the company.

Let’s say you have an American Express card. Having one of these cards signifies status and achievement, meaning you are more likely to notice if another person has one also. When you have brand loyalty and use an item consistently, you’re better able to identify certain trends, such as more people having the American Express card, indicating a growing customer base. Perhaps American Express may make for a great investment? Warren Buffett has held stock in American Express since the 1980s.

This firsthand experience gives you an edge, allowing you to spot trends before the broader market catches on. You’re also in a great position to readily assess the quality of the product or service being utilized and/or the level of customer satisfaction incurred. Your experience likely translates to that of other customers as well, and it can provide a compelling instinct on why a certain business may make for a good investment.

Contribute to Revenue Growth

A study by Texas A&M found that investors who purchased a product or service increased their weekly spending on that brand by 40%. Not to mention that discussions around that product or service likely occurred between family members, friends, and coworkers, generating interest and further adding to more purchases and the subsequent growth of the company.

When you invest in a company you know, you are able to easily talk about the brand and help build loyalty and trust, providing more support via purchases and potentially leading to stronger financial performance for those companies.

Warren Buffett has been a long-time investor in companies like Coca-Cola and American Express. And guess what… he consumes Cherry Coke constantly, and he utilizes his American Express card regularly. McDonald’s stock is also held by a subsidiary of Berkshire Hathaway, and Buffett is a regular consumer of McDonald’s as well.

As a whole, part of Buffett’s investment strategy has always entailed investing in the companies whose products and services he uses regularly: Coca-Cola, American Express, Sees Candy, GEICO, McDonald’s, etc.

Although you might not make much of a difference as one person, think about how many others hold the same sentiment.

Properly Evaluate Competitors

If you’re like most people, you prioritize quality. Would you want a streaming service known for delays and glitches? Probably not.

As a consumer, you are going through the same purchasing process as others. If you believe in the products and services enough to use them, that's a good indicator that others might, too. And if you’re compelled to use them versus any similar products made by competitors on a consistent basis , that’s a great indication the companies behind those products may make good investments.

For example, if you reach a consensus that Netflix is the best streaming brand, other customers are likely to arrive at the same conclusion. And if you stumble across a new product and are able to reach such a conclusion before most everyone else, then you may also be better positioned to invest in that company early at a more reasonable price point before the masses push the stock price up.

By being a consumer first and an investor second, you can properly evaluate competitors and choose investments that will stand the test of time. But don’t just depend on your perspective as consumer. In considering any such company as an investment, it’s important to conduct research & analysis on that particular company, along with a competitive analysis on its key peers.

Compare the company’s products or services to similar such products of other companies, and be sure the company you’re investing in has a competitive advantage in its space. Explore the historical financial performance of your target company and its key peers, with an assessment of the future outlook of all. Reading more Raising InvestorIQ write-ups will provide you with the proper skills and knowhow to conduct such an analysis.

Isolate the Best Companies to Invest In

As an end-user, being familiar with the products or services of particular companies is one thing, as it’ll help you identify a list of companies as potential investment opportunities. But take it another step and be sure to isolate the very best companies that may exist within the range of companies that you buy products from.

The way to do this is to analyze any such companies for the presence of a durable competitive advantage. It is the competitive advantage of a company that allows it to make monopoly-like profits, which will ultimately translate into strong returns for you as an investor (return on investment or ROI). So, you want to be sure this is present within any companies that you consider for investment.

Competitive advantage exists within two types of businesses – those that produce a unique product and those that provide a unique service. We’re talking products or services that cannot be easily replicated by other companies with deep pockets. The competitive edge can be as simple as a brand name, but the business must be able to keep its competitive advantage well into the future.

And seek out companies that, ideally, don’t have to expend large sums of capital to maintain that competitive advantage. This is what we call a low-cost durable competitive advantage. Such companies make-up the best investment prospects for two reasons:

Predictability of earnings power.

An enhanced ability to expand shareholder value rather than spending that money just to maintain any perceived competitive advantage.

Additionally, a company with the financial power of a durable competitive advantage will have the ability to withstand almost any “bad-news” situation that may cause a temporary decline in its stock price.

Removing Bias: Evaluating Your Investments

Have you ever trusted someone so much that you couldn’t see through their lies? This could be an individual on social media, a friend, or even a family member. Too often, investors fall into the same trap, giving companies chance after chance when they need to move on.

Don’t depend on word of mouth or loose information seen online. And don’t just depend on analysts’ opinions or even your personal customer experience. Staying informed and conducting due diligence by way of your own investment research and analysis will lend confidence to your investment decisions.

By doing so, you gain intimate familiarity with the facts and the data surrounding companies that serve as prospective investment decisions. This will allow you more confidence in your buying decisions, as well as any decisions on when to exit certain investments.

Here are some ways to evaluate your investments objectively and help remove bias:

Watch Market News and Earnings Reports

Market news is a great way to gain access to information about your investments. There are dozens of platforms that report on new projects and development initiatives taken by companies. Take a few hours to review your holdings. In many cases, you might already have expert insight on updates and changes since you are using the products and services. Keep in mind that you want to evaluate trends, not events.

Similarly, public companies are required to issue financial statements. You can easily find these documents once they’ve been released on the websites of most companies under their “Investor Relations” section and in the form of annual (10-K) or quarterly (10-Q) reports.

Review these documents within an investment analysis to determine if revenue and earnings are improving or if the company is facing hard times. Remember, temporary declines are not the end of the world, and they may even make for solid buying opportunities. However, if the company is showing consistent losses and cash flow issues, you might need to examine more closely and rework your portfolio.

Take a Long-Term Approach

The most successful and profitable investments are generally those with the longest timeframe. This gives your investments time to recoup lost value in the short-term, pay out dividends, and appreciate in value.

Even if your investments appear to have short-term volatility, be sure to look at the big picture. Take a look at Starbucks’ stock price below.

Starbucks’ 6-month stock performance

Back in May, when you saw a sharp drop-off, you might have wanted to sell your shares. As the lows continued throughout the summer, you might have grown wearier.

However, look what happened at the end of August. The stock rebounded and has been trending upward. Just because Starbucks discontinued your favorite drink doesn’t mean you should sell! (Note: Be sure to check out our latest in-depth write-up on Starbucks, Something’s Brewing at Starbucks for perspective and analysis of the potential impact of its new CEO, Brian Niccol).

Conclusion

Do you currently invest in any companies whose products you use on a daily basis? Investing in what you know is a great way to stay in the loop on a stock’s performance and contribute to its revenue growth. It’s also likely that you understand the business model of such companies, and understanding what you invest in is strategically important.

Warren Buffett readily admits to limiting his investment choices to companies that he understands, which is part of the reason he tends to avoid investing in technology companies. Such an approach is commonly referred to as investing in areas that make up your circle of confidence. Buffett feels that an ability to determine a company’s competitive advantage is contingent on understanding the nature of the business and the products that it makes.

Assessing whether a company’s products have been around for a long period of time is relatively easy, but determining whether those products will be around for another 10+ years from now is far more difficult without a firm understanding of the company and the products it makes.

It's about investing in what you know and trust, which can be a powerful strategy for long-term growth.

If you’re searching for more investment insights or strategies, check out our other blog posts or sign up for our newsletter to expand your investment education and grow your wealth.

For more robust and meaningful Investing insight & analysis, consider subscribing to RIIQ Pro, our premium newsletter:

A company-specific Deep-Dive Analysis (provided weekly)

A detailed write-up of a RIIQ Key Investing Insight (provided weekly)

RIIQ Top 10 Watchlist - a list of the top 10 companies being monitored and evaluated heavily due to varying factors, along with details of why they may be in our top 10 (provided monthly)

Bonus: A FREE download of Legendary Investor Insights. 10 pieces of practical wisdom from legendary investors like Warren Buffett, Peter Lynch, Charlie Munger, and many more.

Sign up now for a limited-time offer of only $9.95 per month!

Subscribe for FREE to the Raising InvestorIQ YouTube Channel for more leading Investing info, insight, and analysis.

Do you want to invest on your own (but don’t know where to start)? Tykr gives beginners the power to manage their own investments with confidence.

14-Day FREE trial when you sign-up!!

Disclosure/Disclaimer

As a Tykr affiliate, Raising InvestorIQ earns from qualifying purchases. As a Seeking Alpha affiliate, Raising InvestorIQ earns from qualifying purchases.

Information provided on this site is based on my own personal experience, research, and analysis, and it is not to be construed as professional advice. Please conduct your own research before making any investment decisions. I am not a professional financial advisor, stockbroker, or planner, nor am I a CPA or a CFP.

The contents of this site and the resources provided are for informational and entertainment purposes only and do not constitute financial, accounting, or legal advice. The author is not liable for any losses or damages related to actions or failure to act related to the content on this website.